Now that the federal government has—for the moment—embraced what Brookings Metro calls “place-based industrial policy,” it’s important to remember why it’s doing so.

Above all, place-based industrial strategies are a mechanism for getting more leverage on urgent economic problems, whether it’s geopolitical competition, climate change, or inequality. Yet equally high on the list of such critical problems is the imperative of boosting vitality in the nation’s “advanced industry” clusters.

As Brookings Metro has defined and tracked over the last decade, advanced industries such as auto manufacturing, pharmaceuticals, clean energy generation, and digital services are “advanced” because they invest heavily in research and development and employ large numbers of STEM workers. Together, these high-value, export-intensive industries account for 90% of private sector R&D spending; saw their wages grow 1.7 times faster than elsewhere in the economy; and have created 7 million decent-paying jobs that typically don’t require a bachelor’s degree.

In short, advanced industries are the crown jewels of U.S. economic dynamism. But over the last two decades, these 46 critical industries have been struggling, both as a nationwide sector and as local ecosystems.

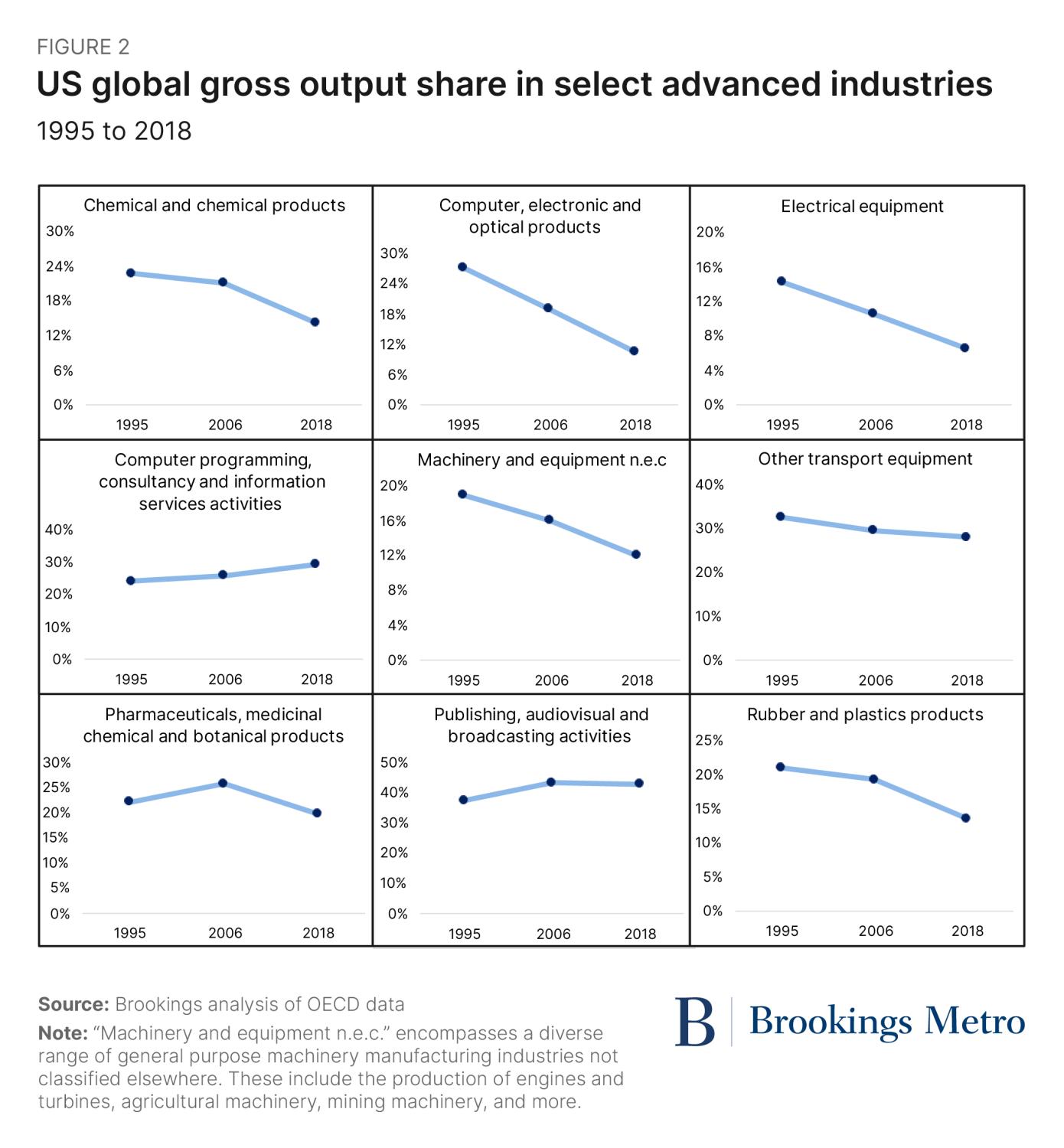

Granted, these industries’ absolute output has mostly increased over that time. However, looking at the years between 1995 and 2018, these industries’ global market share has mostly declined. For example, across that period, the U.S. share of advanced industries’ global gross output dropped from 24% to 18%, after peaking at 29% in 2001.

To be sure, several U.S. digital services industries have registered solid gains in their global market share. For example, between 1995 and 2018, the U.S. share of global computer programming, consultancy, and information services activities expanded from 24% to 29%. Yet most other U.S. advanced industries—from machinery and equipment to plastics and rubber to electrical equipment—have lost global market share as their competitiveness declined.

The Information Technology and Innovation Foundation’s Hamilton Index has made similar findings: Since 1995, the United States’ global market share in advanced industries has fallen 6% below its expected size-adjusted share. Comments ITIF: “Leaving out the IT and other information services sector, the U.S. relative share of global advanced-industry output fell by 16 percentage points. In other words, the real strengths of the U.S. software and information sector mask serious weaknesses in most of the rest of America’s advanced industries.”

Such slippage has brought with it disturbing domestic ramifications. For one, real average wages have stagnated in many of the slumping advanced industries (though not in the digital ones). What’s more, U.S. advanced industries’ employment growth has eroded to levels substantially below where it started in 2001, despite the rapid growth of the software and tech sector. Overall, the 46-industry sector shed 734,000 jobs from 2001 to 2019—a total employment decline from 12.8 million jobs to just over 12 million. Only 10 of these 46 industries added jobs, while 36 shed them.

The geographic imbalance of these industries is even more disturbing. In just seven of the nation’s 100 largest metropolitan areas did the critical advanced industry ecosystem expand its share of the region’s employment. Those with most vibrant advanced industry centers were coastal tech hubs (San Francisco and Seattle), college towns (Madison, Wisc., Provo, Utah, and Raleigh, N.C.), as well as Charleston S.C. and Albany, N.Y. Everywhere else, advanced industries’ regional employment share has been going sideways or slumping.

All of this goes to show that when President Joe Biden took office in 2021, the nation’s most critical advanced industry clusters were in most cases losing ground, both globally and as domestic mainstays. Or to put it another way: Some of the nation’s most glaring economic problems had turned out to be geographic problems.

Hence the critical importance of “Bidenomics” and its sub-theme of place-based industrial policy. With sizable industrial development investments now at the core of the government’s economic agenda, the nation has begun to attempt to restore the vibrancy of its drifting advanced industry ecosystems—a key starting point for economic resurgence.

The Biden administration’s three major economic spending bills—the Infrastructure Investment and Jobs Act, CHIPS and Science Act, and Inflation Reduction Act—promise some $2 trillion in infrastructure, innovation, and green-transition investment over the next decade. In doing so, they also represent a major dose of public investment targeted toward the nation’s advanced industry sector. Together, these bills are beginning to recoup the nation’s previous shortfalls in infrastructure, innovation, and clean-technology investment, and should help restore U.S. competitiveness in advanced industries.

Yet the geographic nature of advanced industry activity means that broad background investment won’t be sufficient to revitalize individual local clusters. Instead, “place-based” investments—such as those in Economic Development Administration’s new Regional Technology and Innovation Hubs program and the National Science Foundation’s Regional Innovation Engines initiative—will likely be necessary to truly stimulate these ecosystems and industries.

Most notably, place-based strategies—unlike broader investments—can target the “micro” underpinnings of “macro” performance issues. They can do this by reshaping and optimizing existing interactions among stakeholders, institutions, and networks within a given cluster. Place-based strategies can also intervene in specific local technology clusters or “industrial commons” with targeted investments in order to open up new potential.

Additionally, place-based public investments—targeted toward critical industries in critical places—can mobilize follow-up private investments, as White House Chief Economist Heather Boushey pointed out last month. That’s what the White House means when it says these investments can “crowd in” private capital in particular places.

As such, place-based industrial policy has the potential to invest with special efficiency to address gaps in local clusters, tech ecosystems, or entrepreneur-support systems. Far from a secondary experiment, the nation’s use of place-based policy focuses on one of the most urgent economic issues we face. Given that, both the global competitiveness and local vibrancy of our critical advanced industries hang in the balance.